Digital Banking Solutions

Digital Banking Solutions

Next-generation infrastructure, capabilities, and strategic support for digital-first banking models

Design. Deploy. Scale. Digital Banking with Impact

At Hagan Smith, we help financial institutions design, deploy, and scale digital banking propositions that meet the demands of today’s hyper-connected, regulation-heavy environment. Whether launching a greenfield digital bank, transforming legacy infrastructure, or embedding financial services into partner ecosystems, we provide the technical platforms and strategic oversight to deliver sustainable digital banking success.

Full-Spectrum Digital Banking, From Core to Compliance

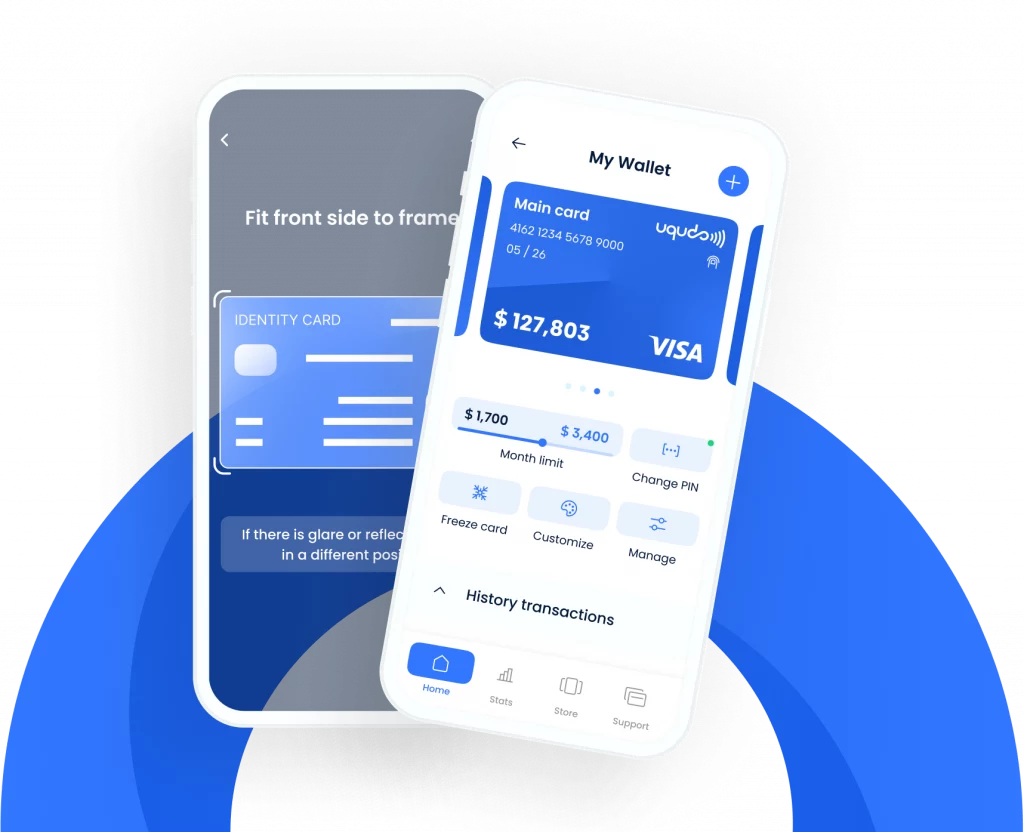

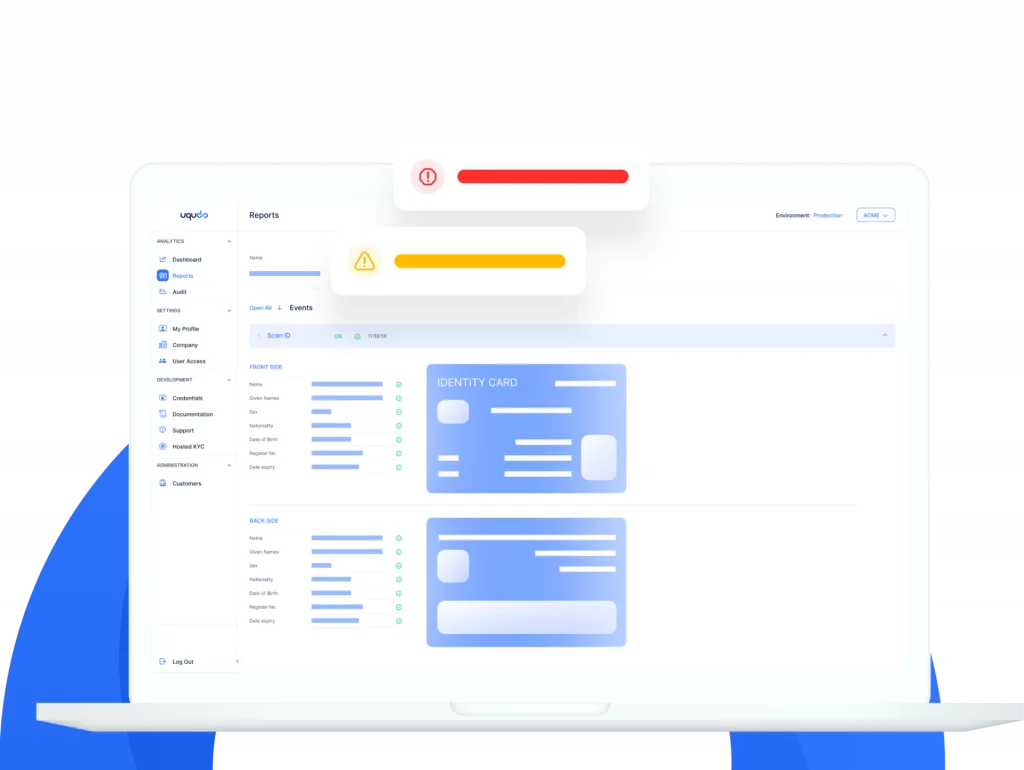

Our modular, API-driven solutions cover the full banking value chain: core banking; digital onboarding; ID verification; KYC/AML; transaction monitoring; customer communications, and regulatory reporting. Through curated partnerships with leading fintech vendors, and our own platform integration expertise, we offer flexible, cloud-native architectures that can be deployed in weeks, not months.

Your Trusted Partner for Digital Banking Execution

We work with challenger banks, EMIs, credit institutions, and fintech scale-ups to build compliant, resilient operating models that balance innovation with governance. From selecting the right technology stack to navigating PRA/FCA authorisations and embedding operational risk controls, Hagan Smith acts as a trusted guide and execution partner.

Beyond UX: Building Digital Banks That Endure

Digital banking is no longer just about mobile apps or sleek UX. It’s about trust, resilience, and adaptability. Our mission is to help you build digital banking propositions that endure, and that regulators, investors, and customers trust.

Let Hagan Smith help you build a digital bank that’s ready for the future.