Digital Footprint Analysis

Digital Footprint Analysis

Behavioural insights from digital footprints, detect fraud, assess creditworthiness, and personalise decisions in real time.

Beyond Static Data: A New Era of Risk Intelligence

At Hagan Smith, we help clients move beyond static data and traditional risk markers by unlocking the rich behavioural intelligence hidden in every user’s digital footprint. By analysing how users interact online, from device signals and navigation patterns to session metadata and behavioural biometrics, we help organisations detect fraud, assess intent, and drive smarter decisions.

Real-Time Behavioural Scoring for Smarter Risk Decisions

Through our integration of our cutting-edge technology, we offer real-time behavioural profiling and scoring that can be used for credit risk, fraud prevention, and customer segmentation. This capability is especially powerful for thin-file or underbanked customers, enabling firms to responsibly extend services while managing exposure.

Making Sense of the Digital Footprint

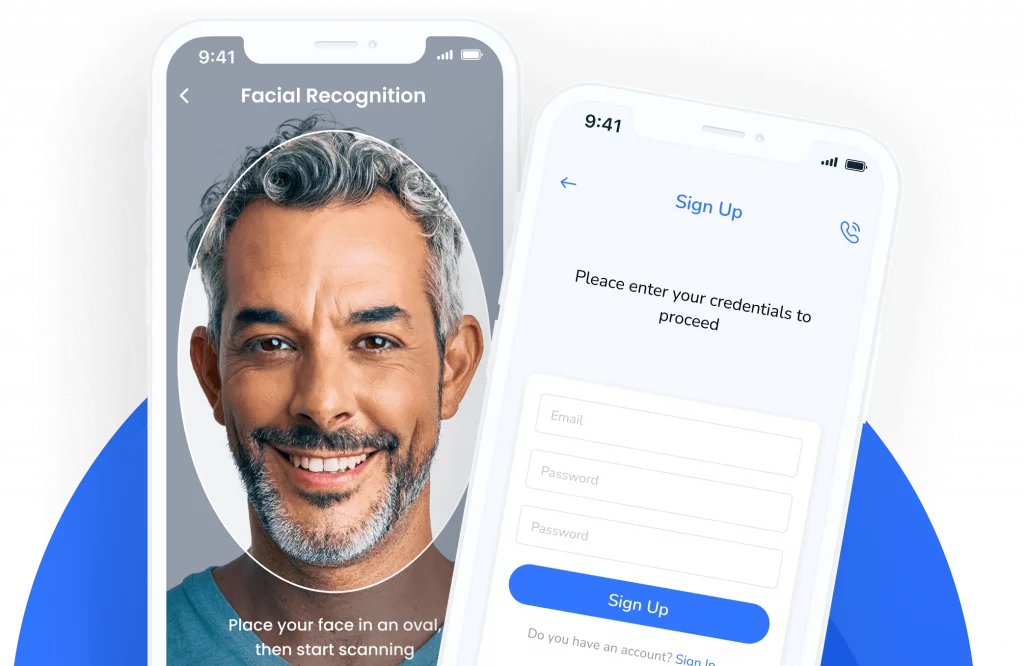

Digital footprint signals, such as keystroke dynamics, device characteristics, browser configurations, and interaction cadence, can reveal indicators of synthetic identities, bots, or manipulated applications. These signals also enable dynamic assessments of user trust, adaptability in onboarding flows, and enhanced personalisation.

Expert Guidance Across Governance, Risk, and Operations

Our role goes beyond providing the tool, we advise on governance, model thresholds, risk policy integration, and operational impact. Whether you are onboarding new customers, processing credit applications, or detecting anomalies in ongoing relationships, Hagan Smith helps you deploy digital behavioural intelligence safely, effectively, and in full regulatory alignment.

The future of risk and decisioning is behavioural. We help you act on it today.